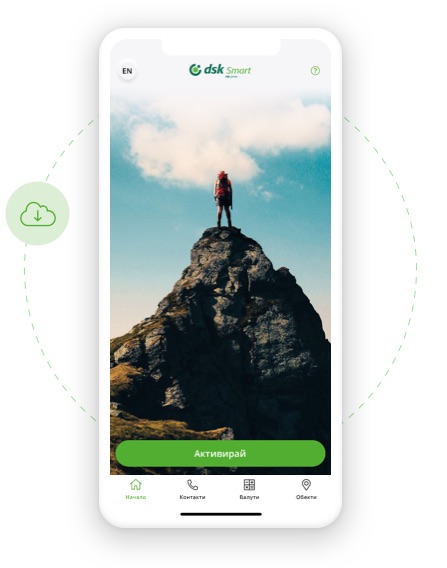

DSK Bank’s mobile banking application for individual clients

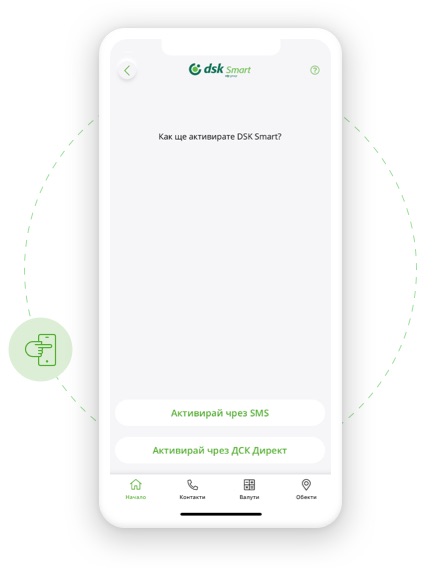

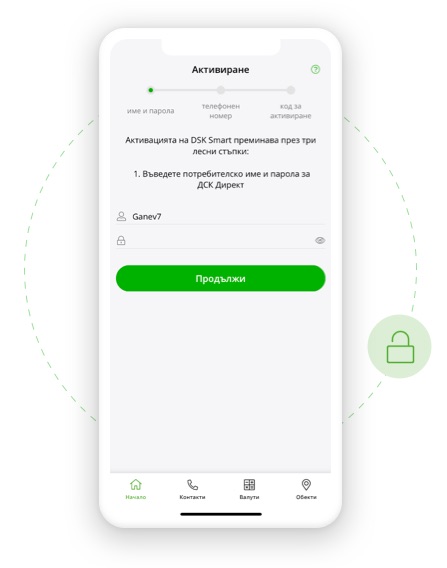

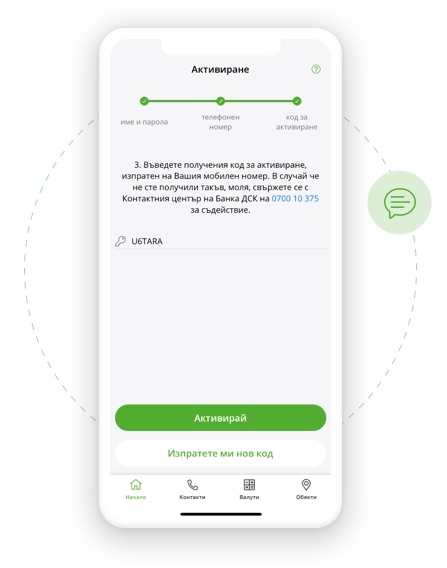

How to activate DSK Smart on your phone:

Blink P2P transfers by mobile number in DSK Smart

- No fee

- Send money to even more friends, regardless of their bank in the blink of an eye.

- You translate 24/7, 365 days a year.

- Add a Trusted Recipient from your phone book. You can send various amounts to them without signing.

- You send small amounts up to EUR 30 without a signature method.

Adding accounts

To add accounts to track in DSK Smart, log in to DSK Direct e-banking, go to the Smart Applications menu, and select the accounts you want to view in mobile banking.

Accounts in other banks

Use just one mobile app to monitor the balance and movements in your accounts at different banks. Go to the More menu, select the Accounts at other banks submenu, and follow the steps to activate the service.

How to transfer money using blink via IBAN in DSK Smart:

- Select New Transfer from the Transfers menu.

- Fill in the fields for the transfer: recipient's name, IBAN, and amount.

- Select BLINK and you're done! The transfers arrives in seconds.

The DSK Smart mobile banking app gives you access to:

Bank Transfers:

- Schedule transfers by phone number

- Third-party bank transfers with an authorized signature from a token, the mobile app DSK mToken, or a verification code via SMS

- Utility bill payments

- Transfers between your personal accounts

Account Statements:

- Receive statements for up to three of your personal accounts even before you log-in to the app

- Your personal credit information such as available credit, statement balance, payment due date, and more

- Utility bill statements

- Transaction history in DSK Smart

Information about products and services:

- Online credit applications (credit cards, personal credits, overdrafts)

- Messages from the DSK Bank

- Your personal credit information such as available credit, statement balance, payment due date, and more

- Information about currency conversions and rates

- Information about your bank cards

- Information about our bank offices and branches.

Manage your funds:

- Information about temporary account freezes and card limits

- Virtual savings

- Virtual card top-ups

- Manage your current accounts

You can personalize your DSK Smart app

- Access the app through biometric data or pin code

- Activate dark mode or change your screen orientation to horizontal

- Add shortcuts to your main screen, gaining easy access to your most used features

.svg)